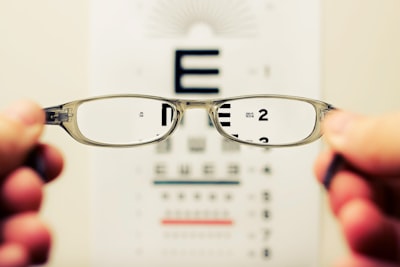

You can live a happier and healthier life by taking steps to maintain your overall well-being. Health insurance is an essential facet of a well-rounded self-care plan. But health insurance doesn’t cover everything; most health plans exclude vision coverage. So when protecting your eye health, you should consider vision insurance.

What Is Vision Insurance?

Vision insurance is essentially health insurance for your eyes. Like other forms of insurance, you contract with an insurance company for coverage. In turn, for regular premiums, the insurance company promises to pay for services and claims as outlined in your policy.

How Does Vision Insurance Work?

Like health insurance, vision insurance comes with details that can vary by policy. Typically, you can schedule eye-care services, such as routine eye exams, and the provider will bill the insurance company. Under some plans, you might be reimbursed for costs afterward.

Depending on your chosen policy, you may be responsible for a portion of the expenses when you undergo services. These expenses may include deductibles, copays and coinsurance. Most vision insurance policies will also include exceptions; coverage details can vary.

Considering that policies are unique, ensure you understand all policy details before securing vision insurance. The experts at Wimmer Insurance can help outline everything you need to know when considering your options.

Why Should I Consider Vision Insurance?

Vision insurance can be invaluable for those who need corrective eyewear, such as glasses and contacts. However, this insurance can be helpful to anyone who’s proactive about their health—even if you don’t need glasses.

During eye exams, your eyes are checked for various health issues, some of which may go unnoticed until they progress into severe forms. Some conditions looked for include high blood pressure, diabetes and glaucoma, in addition to assessing general eye function and health.

Since traditional health plans often don’t include your eyes, vision insurance can be vital for maintaining good eyesight for years to come. You use your eyes every day, so why not ensure they’re healthy? Contact Wimmer Insurance today to review affordable vision plan options.

This blog is intended for informational and educational use only. It is not exhaustive and should not be construed as legal advice. Please contact your insurance professional for further information.